The tiny house movement ties in strongly with the growing global trend towards minimalist living, particularly among Millennials with a strong social conscience:

“One of the main appeals of minimalist living is the social consciousness. Buying less clothes means less exploitative sweatshops, consuming fewer products reduces the growth of landfills or plastic islands in the ocean and living in a tiny house that needs less power means more space and natural resources for others.”

Advocates of the minimalist lifestyle claim that it has powerful benefits across every aspect of life – people who choose to live with fewer possessions have more money, more time, more flexibility and less stress.

A study by a psychology professor at Knox College in Illinois even found that people who chose to simplify their lives – regardless of age, gender and location – reported “significantly higher levels of life satisfaction, more experiences of pleasant emotion and fewer experiences of unpleasant emotion.”

These days, living without clutter is becoming easier and easier, thanks to digital technology and the rise of a culture that values ‘access over ownership’.

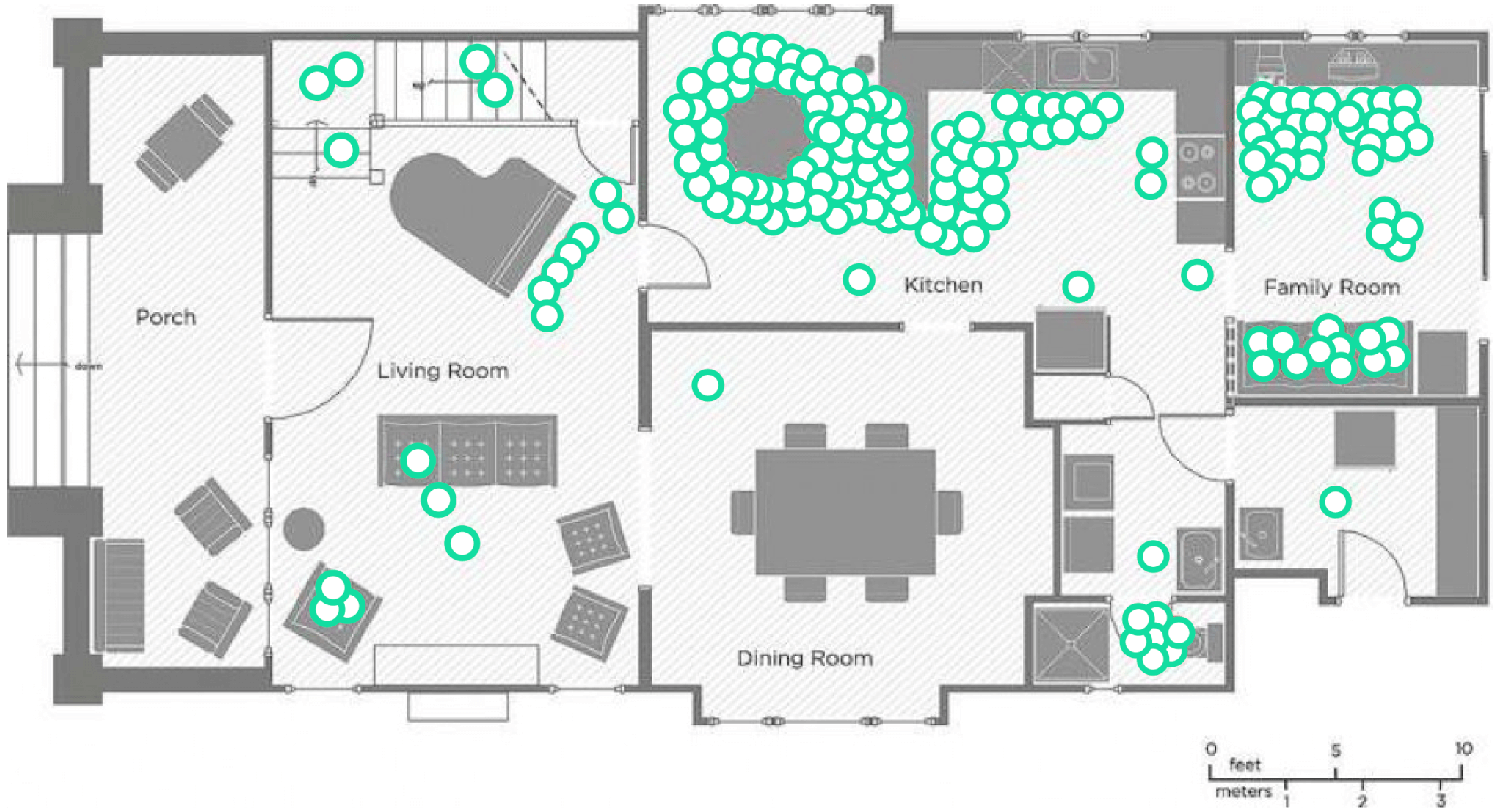

Just take a look in the average garage, shed, cupboard, spare-room, loft… you’ll probably find a common occurrence… stuff that never gets used.

Community car-sharing services like Cityhop and Yourdrive, not to mention Uber, mean that many city-dwellers are saving the expense of owning – and garaging – a car. Meanwhile, digital downloads and media streaming services like Netflix, Lightbox and Spotify, mean that people no longer need space to store large libraries of books, music and movies.